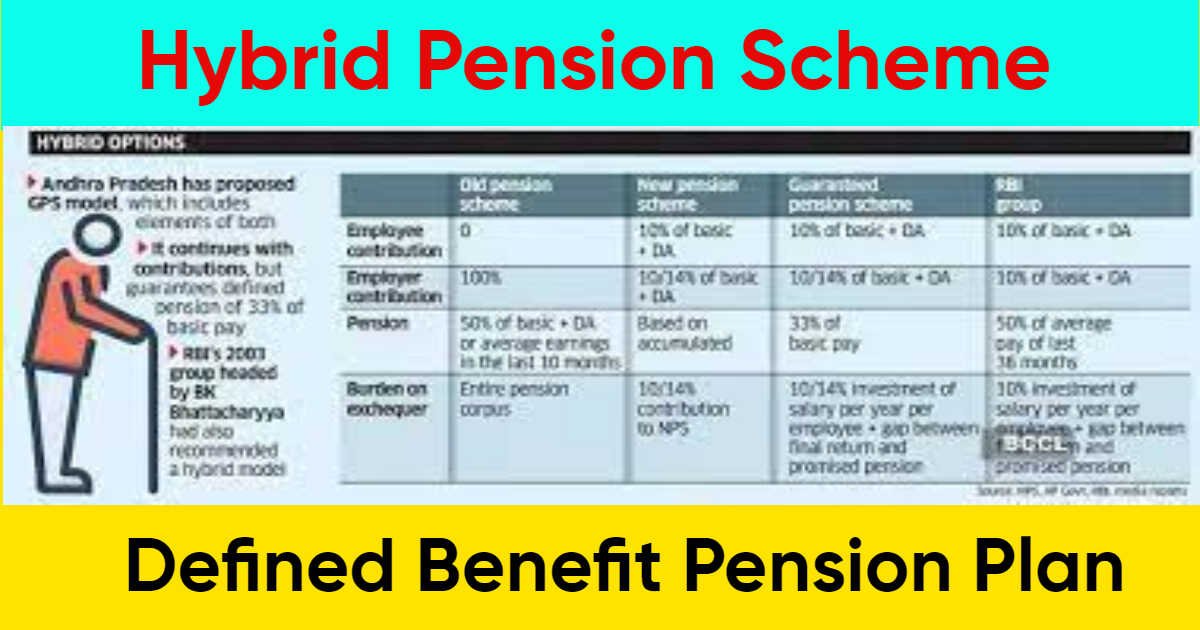

A committee formed by the Modi government to look into the issue of pension schemes for central and state employees may recommend that states be allowed to adopt something similar to the hybrid Guaranteed Pension Scheme implemented by the Andhra Pradesh government, which combines features of the old and new pension schemes, DH has learnt.

A Central government-appointed panel to look into the issue of pension schemes for central and state employees is likely to recommend that states be allowed to adopt hybrid pension scheme similar to the one implemented by the Andhra Pradesh government.

A committee formed by the Modi government to look into the issue of pension schemes for central and state employees may recommend that states be allowed to adopt something similar to the hybrid Guaranteed Pension Scheme implemented by the Andhra Pradesh government, which combines features of the old and new pension schemes

hybrid pension scheme

The panel is headed by Finance Secretary T V Somanathan, and was set-up in early April, in the backdrop of a number of Opposition-ruled states having reverted to the dearness allowance-linked Old Pension Scheme (OPS) and employee unions in many states are asking for the same.The hybrid model (guaranteed pension scheme) is something we are examining closely. A few meetings have taken place and it is likely that a scheme which has the best features of both OPS and NPS will be recommended,” the official said.

The panel was formed in April following a wave of states, run by opposition parties, switching back to the dearness-allowance linked Old Pension Scheme (OPS).The panel’s exact submission deadline has not been announced, although it is anticipated that the report will be presented to Finance Minister Nirmala Sitharaman in July, reported citing a senior official.

The committee is likely to suggest to the Centre to allow states to adopt a scheme similar to the ‘Guaranteed Pension Scheme’, a hybrid model implemented by the Andhra Pradesh government, which contains elements of both the OPS and New Pension Scheme (NPS), according to the DH report.

The Centre’s main concern is that OPS would increase the outlay of the states and thus may impact their stated fiscal deficit targets of 3.5 per cent of respective gross state domestic products (GSDP),” said the second official. Fiscal deficit is the difference between a government’s expenditure and revenue, when the former is higher, and is the most important indicator of centre or states’ financial health.

The OPS offers fixed pensions to employees after retirement. The pension amount is 50 per cent of their last drawn salary. The NPS, meanwhile, is an investment-cum-pension scheme. NPS contributions are invested in securities like debt and equity instruments. Thus, it does not guarantee fixed pensions but provides high returns in the long term, resulting in a significant lump sum and monthly pensions.

Types of Hybrid Pension Schemes

Over the years, several forms of hybrid pension schemes have experimented in the market. Some of the prominent variations of the hybrid schemes have been mentioned below:

- Combination schemes are quite popular amongst many employers and employees. Combination schemes are a combination of defined benefits as well as defined contribution plans. Hence, a percentage of the funds contributed are allocated towards defined benefit plans whereas another percentage is allocated towards defined contribution plans. The end result is that the risk is not borne by either party but is shared between the two. However, such plans can become quite complicated and the average retiring employee is unable to understand the workings of these plans.

- Final salary lump schemes are also a hybrid between defined benefit as well as defined contribution schemes. Under this scheme, the employer guarantees the amount of money that they will pay to the employee as a lump sum during retirement.For example, an employer may pay 10% of wages for every completed year of service. Hence, if a person has worked in the same company for 40 years, then they will be eligible to receive 400% of their annual salary as a lump sum. This money is then used to buy pension annuities at the market rate. Hence, the employer is only responsible for providing a fixed sum till the retirement date. The monthly payment which the employee will receive will still be bound by the market rate.

- Self-annuitizing schemes are the opposite of fixed salary lump sum schemes. Here too, the risk is shared between the employer and the employee. However, the components of risk-sharing are reversed.This means that the first component i.e. the contribution of money into the scheme is done at the market rate. Hence, the employer and employee keep adding money to the pension scheme. This money keeps growing based on the rates which are prevailing in the market. However, when the employee retires, the lump sum is withdrawn from the markets. At that time, the employer takes responsibility for the lumpsum and promises monthly returns which are in excess of the market rate being offered.

- Underpin schemes are another form of a hybrid pension scheme. As a part of this scheme, the calculation for the payout of benefits is based both on the defined benefit as well as the defined contribution basis. The customer is finally paid out the higher of the two calculations as benefits.Underpin schemes were mainly offered when the transition from defined benefit plans to defined contribution plans was initiated. At that time, employees were scared that they would lose their life savings in case the market went down. Hence, they were guaranteed the minimum payout of a defined benefit scheme if such an event ever took place. Over the years, underpin schemes have been used by some other companies as well.

- Cash balance schemes are like defined contribution schemes in the sense that employees have to contribute money to this scheme. After such a contribution is made, they do not have to rely on the market returns for the money in their account to grow. Instead, the employer provides a fixed rate of return on the investment. This helps smoothen out the unpredictability in the markets to some extent. However, a large portion of the risk is still passed on to the employee via such schemes.

- Fixed benefit unit schemes are schemes in which member accumulates a fixed sum of money for every year of completed service. Usually, there is no link to the amount of money being earned by the employee. The contribution to the scheme is independent of the earnings. This is not beneficial for medium to high-wage earners since the amount being contributed towards retirement is not commensurate with their incomes.

COMBINATION HYBRIDS

Combination hybrids feature a DB component usually providing a more modest pension benefit than the typical public plan, combined with a DC component that usually is mandatory. Combination hybrids are in place, either on an optional or mandatory basis, at the following statewide retirement systems:

- Georgia Employees’ Retirement System

- Indiana Public Employee Retirement Systems (PERS and TRF)

- Michigan Public School Employees’ Retirement System

- Ohio Public Employees’ Retirement System

- Ohio State Teachers’ Retirement System

- Oregon Public Employees Retirement System

- Rhode Island Employees’ Retirement System

- Tennessee Consolidated Retirement System (effective 7/1/14)

- Utah Retirement Systems

- Virginia Employees Retirement System (effective 1/1/14)

- Washington Department of Retirement Systems

Defined Benefit Pension Plan

There are many possible types of hybrid schemes.

In a combination scheme, a member may be accumulating two types of benefit simultaneously. This would typically be a DB element for a portion of income and a DC element on any earnings over that amount.

Self-annuitising DC schemes operate identically to DC schemes until a member retires. At that point, the accumulated fund is converted to pension income, not at the market rate for pension costs (annuity rates), but in accordance with a process which is set out in the rules of the scheme. The pension is then paid from the scheme.

Under final salary lump sum schemes, the retirement benefit is expressed as a lump sum at retirement, rather than as a pension. For example, the rules of the scheme may provide a lump sum at retirement of 20% of final salary for each year of service. If a member retired with 40 years’ service, a lump sum of 20% times 40, i.e., 800% (or eight times) final earnings would be used to buy a pension for that member at the market cost at that date.

In an underpin scheme, there is both a DB and DC basis for benefits. At retirement, the member receives a benefit based on whichever calculation provides the better result. For instance, a scheme may have an employer and employee contribution rate of 6% each, with a guarantee that at retirement, a pension of at least 1% of earnings per year of service would be paid as a minimum.

In a cash balance scheme, a member’s benefit is an entitlement to a lump sum at retirement, in a similar fashion to a traditional DC scheme, which is then converted into an annuity. The difference is that the amount in the member’s account is not directly related to the returns achieved on the underlying investments. The returns may be guaranteed, or smoothed (to offset any high or low peaks) or subject to some form of underwriting by the scheme. As a result, member benefits may be slightly more predictable.

Fixed benefit/benefit unit schemes are DB in nature but without any link to earnings – a member usually accumulates a fixed monetary amount of annual pension every year.

What is a hybrid scheme pension?

A hybrid pension scheme is one which is neither a full defined benefit (DB) scheme nor a full defined contribution (DC) scheme, but has some of the characteristics of each.

What is hybrid pension scheme in India?

The scheme, which was proposed in April, offers a guaranteed pension of 50 per cent of a government employee’s last drawn basic pay without any deduction, upon retirement. To avail this benefit, employees will contribute 10 per cent of their basic salary every month while the state government matches it.

What is an example of a hybrid scheme?

For example, an employer may pay 10% of wages for every completed year of service. Hence, if a person has worked in the same company for 40 years, then they will be eligible to receive 400% of their annual salary as a lump sum.

Only #OPS#

Only #OPS#IS solution is solution.