Aided by a buoyant economy, Karnataka Chief Minister Basavaraj Bommai presented a ‘please-all’ revenue surplus budget with no tax hike on February 17, less than 100 days ahead of Assembly elections in the State. The budget outlay has, for the first time, crossed the ₹3 lakh crore mark, and is pegged at ₹3,09,182 crore, up from ₹2,65,720 lakh crore in 2022-23.The State Government of Karnataka on 29th December 2021, has extended the time for payment of tax to avail the benefits under Karasamadhana Scheme on account of inconvenience faced by Trade and Industries due to lockdown imposed in the State.

‘Kara’ means tax and ‘Samadhana’ means Relief. Basically, the scheme is introduced for giving. relief to dealers registered under different Karnataka Commercial Taxes. The Karasamadhana Scheme is introduced by Government of Karnataka through Government order ORDER NO. FD 49 CSL 2021.The scheme is also applicable where the dealer has no arrears of tax but has arrears of penalty and interest only, relating to the assessments or re-assessments completed on or before.The dealer opting for this Scheme shall submit separate application in the format Annexure-I appended to this order under the KST and CST Acts for each year relating to the assessment electronically through the website

Karnataka CM 1 lakh Housing Yojana

karasamadhana scheme 2023

CM Bommai announces GST and Excise tax arrears and penalty to be waived off if it is paid before June 30 under new scheme.Karnataka State Tax Practitioners Association (R), Bengaluru has represented for extension of time for completion of assessments/re-assessment/rectification and withdrawal of appeal and other proceedings on account of inconvenience faced by Trade and Industries due to lockdown imposed in the State to avail the benefits under Karasamadhana Scheme

Karasamadhana Scheme will be introduced with a view to reduce the arrears arising out of the enactments administered by the Commercial Taxes Department which existed before the introduction of Goods and Services Tax Act. Accordingly, a Scheme for waiver of penalty and interest was formulated and issued vide order read above.

kashi yatra yojana Apply Online

Benefits of the Scheme

The scheme is relevant for companies having arrears of penalty and interest as per the Karnataka State taxes. It provides a waiver of arrears of penalty and interest payable by a dealer under various state laws by fulfilling certain conditions. The procedures and form to avail the benefits of the scheme are also mentioned in the order.

Karasamadhana scheme 2023 Karnataka – Eligibility Criteria

- People penalized under section 10-A of the CST act won’t be eligible to apply for the Karasamadhana scheme.

- Applicable only for dealers who do not have any tax arrears but have to pay the interest and penalty

- Applicants must fill and submit the online application form before the last date to reap the benefit under this scheme.

- Applicants must make the payment electronically through the payment modes prescribed in the online portal.

- After making the payment, the challan copy must be taken as a print and submitted to the respective authority attested with the declaration.

Apply for Karnataka Karasamadhana scheme 2023 – Online Application

Candidates interested in the scheme can apply for it online and get a waiver from the government. You must apply before the given deadline. Here are the steps you must follow to apply for the Karnataka Karasamadhana scheme

- Go to the official website of the commercial tax department of Karnataka (https://vat.kar.nic.in/epay/web_e_payment/ksamadhanaMenu.aspx)

- On the main page of the website, the following are the four options you can view

- Click the Application card. The application form appears.

- Enter the applicant name, trade name, address, pin code, and mobile number

- Click Get OTP to generate the OTP, which is sent to the mobile number

- Enter the OTP and click Validate

- Once the validation is done, you can move to the next page to view different acts related to the scheme.

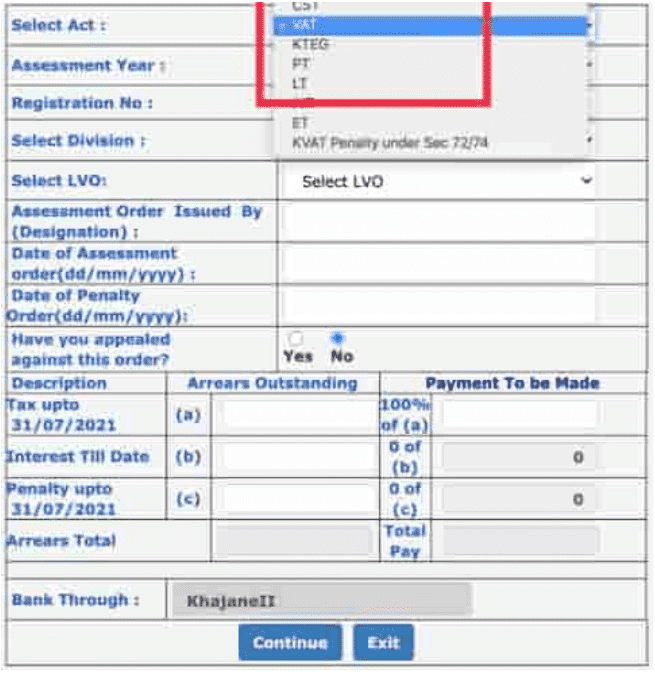

- Select the appropriate Karasamadhana act that you want to apply for

- Select the Assessment year that you want to apply for

- Provide the registration number for assessment and reassessment by the assessing authority.

Note: If you have appealed against this order, then select Yes

- Fill in the other required details in the designated fields

- Click Continue